How Dave Ramsey Changed Our Life

Pivotal moments in your life happen every day. From meeting total strangers on the road to making a wrong turn, life-changing events are always around the corner.

A Positive Detour

The best detour we ever made was when we met this full-timing family in winter 2007. They taught us about Dave Ramey’s debt-free philosophies, which helped us reframe our relationship with money and debt. We assumed once our year-long road trip sabbatical was over, we would join the “real world” again and get into a mortgage and business debt.

The best detour we ever made was when we met this full-timing family in winter 2007. They taught us about Dave Ramey’s debt-free philosophies, which helped us reframe our relationship with money and debt. We assumed once our year-long road trip sabbatical was over, we would join the “real world” again and get into a mortgage and business debt.

Up until that point, we always assumed that we would always be a slave to the man, and debt would be a way of life.

Nobody ever told us the real reasons behind our debt, or how our lives could be better without it.

Dave Says: How He Changed Our Life

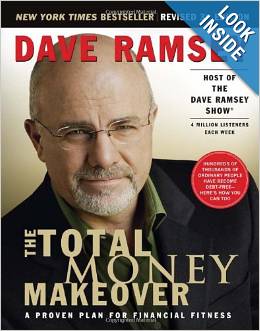

Once we read Dave’s Total Money Makeover book, we learned the real reasons for our debt:

- We were in debt because we spent more than we earned.

- Debt forced us to stay trapped in circumstances we disliked, because it forced us to stick around in order to pay down credit cards and mortgage balances. Our debt was an invisible shackle that attached us to our lenders 24/7.

- Owing others prevented us from living the life we wanted to live; it put earning money at the forefront of our existence, which left us with little time to pursue our dreams.

After paying off our rig and all of our ongoing debts, suddenly we were living the lives we always wanted to live; a life free from obligations to financial institutions.

After paying off our rig and all of our ongoing debts, suddenly we were living the lives we always wanted to live; a life free from obligations to financial institutions.

Be Weird: Say No to Debt

It’s not always an easy road; saying “no” to living beyond your means is a constant challenge. Temptation is everywhere; from delicious restaurants in places like New Orleans, to shiny new RVs with more space.

» Read why Dave says no to RV mortgages!

But now, instead of instantly going for whatever we want as long as we have the credit line to pay for it, we weigh the benefits of that shiny new thing against our current lifestyle. We may not always have the means to afford more extravagant “wants,” but we are happy knowing that each day we enrich our lives with the things that matter most in this world; good memories, and good times.

For more tips about how to live the debt-free lifestyle, check out our e-book, “Income, Anywhere!”

More Resources for Getting Out of Debt

More Resources for Getting Out of Debt

Dave Ramsey offers these additional resources to help you get out of debt. We can help you stay out of debt.

Dave Ramsey’s Complete Guide to Money: The Handbook of Financial Peace University

Deluxe Executive Envelope System (Dave Ramsey’s Financial Peace University)

No comments yet.